About

Projects

Sault

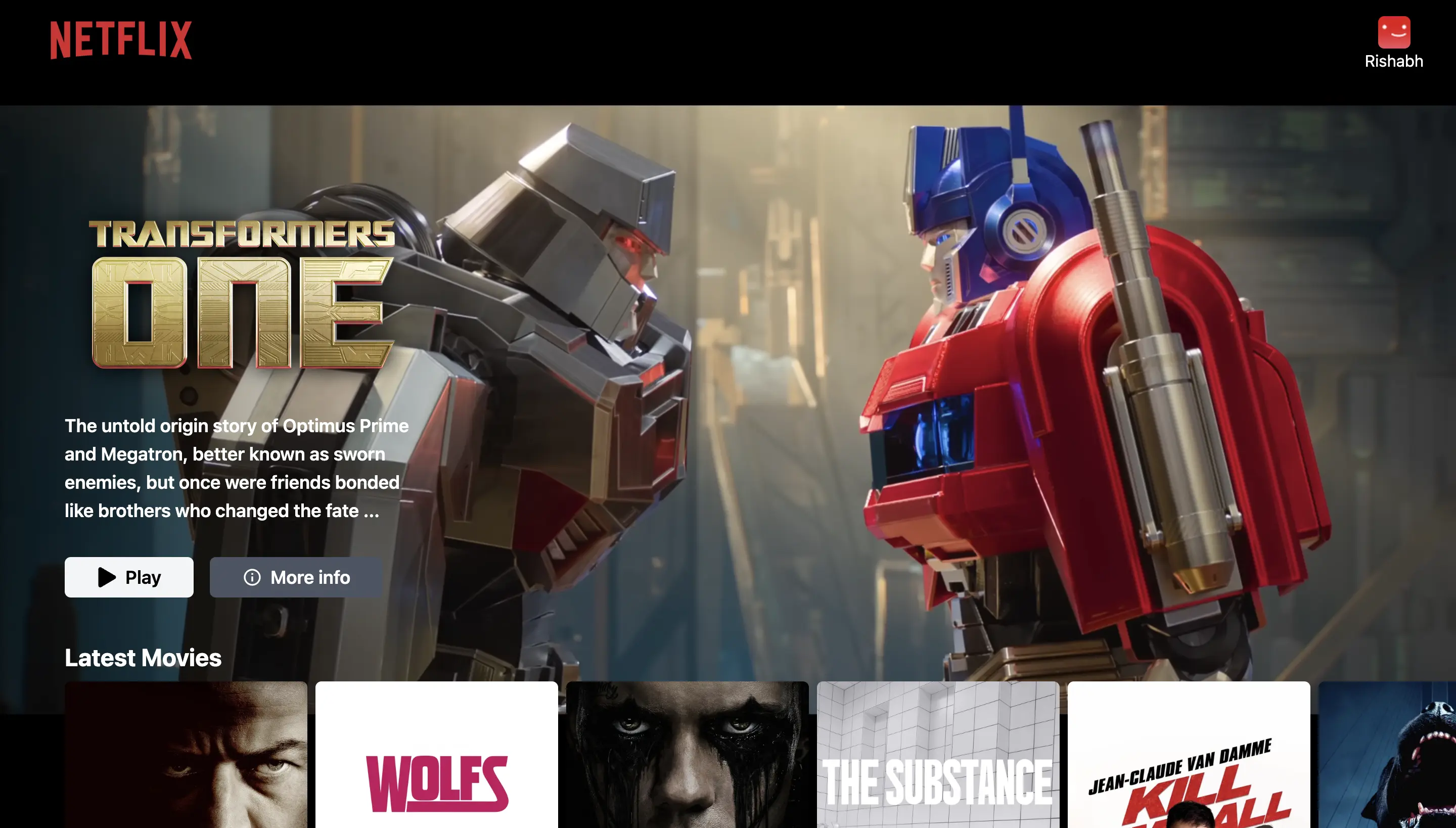

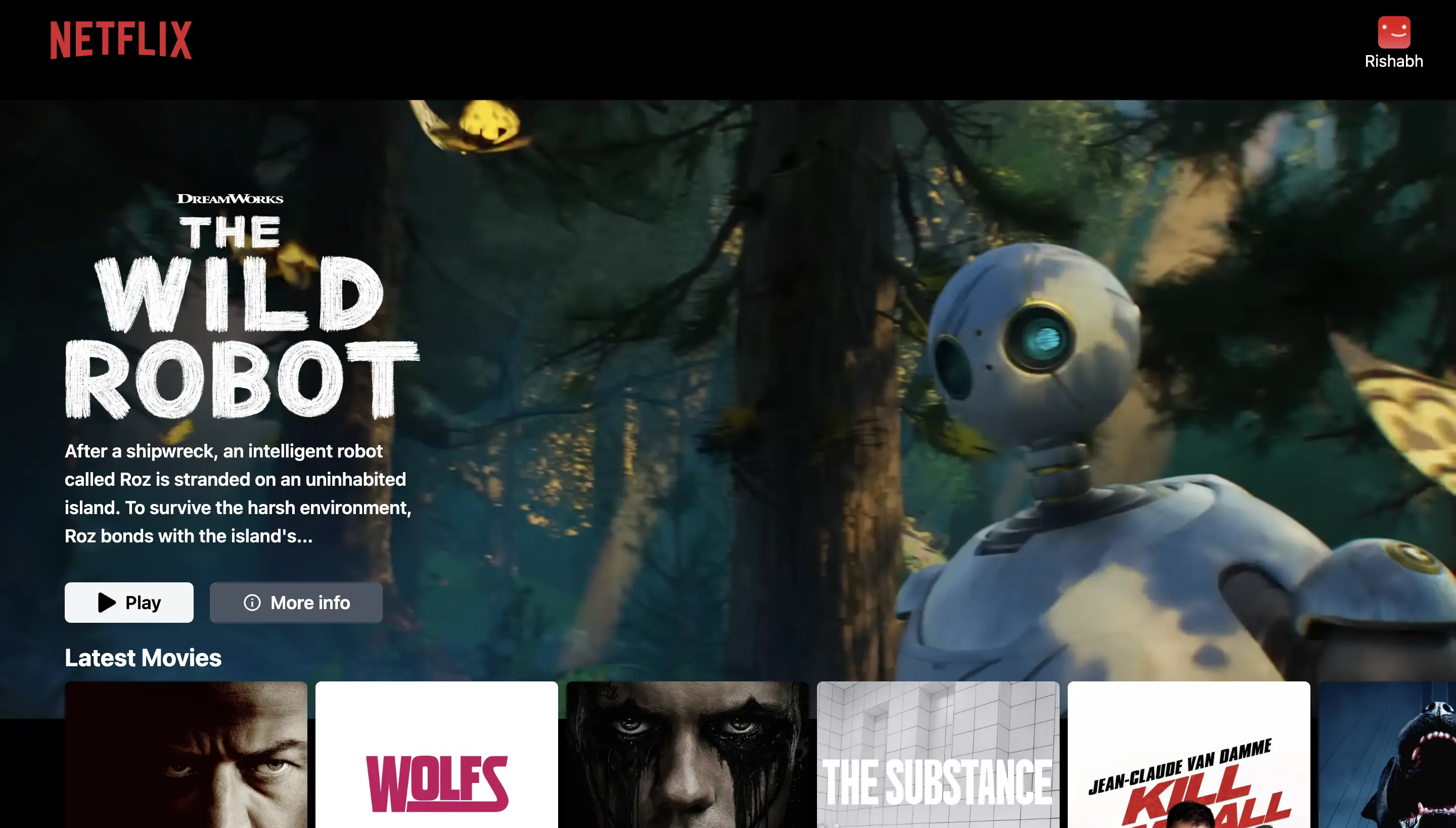

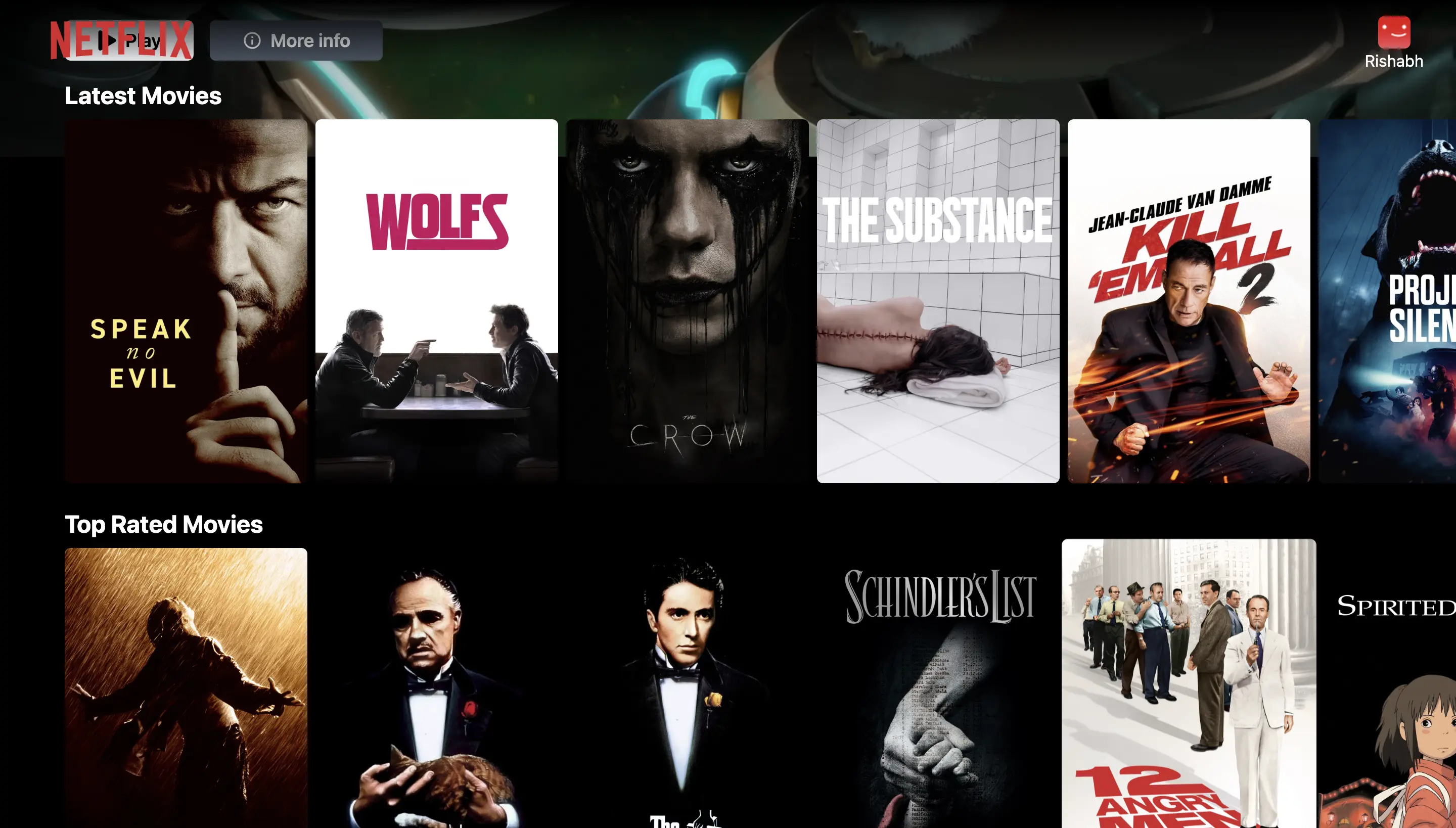

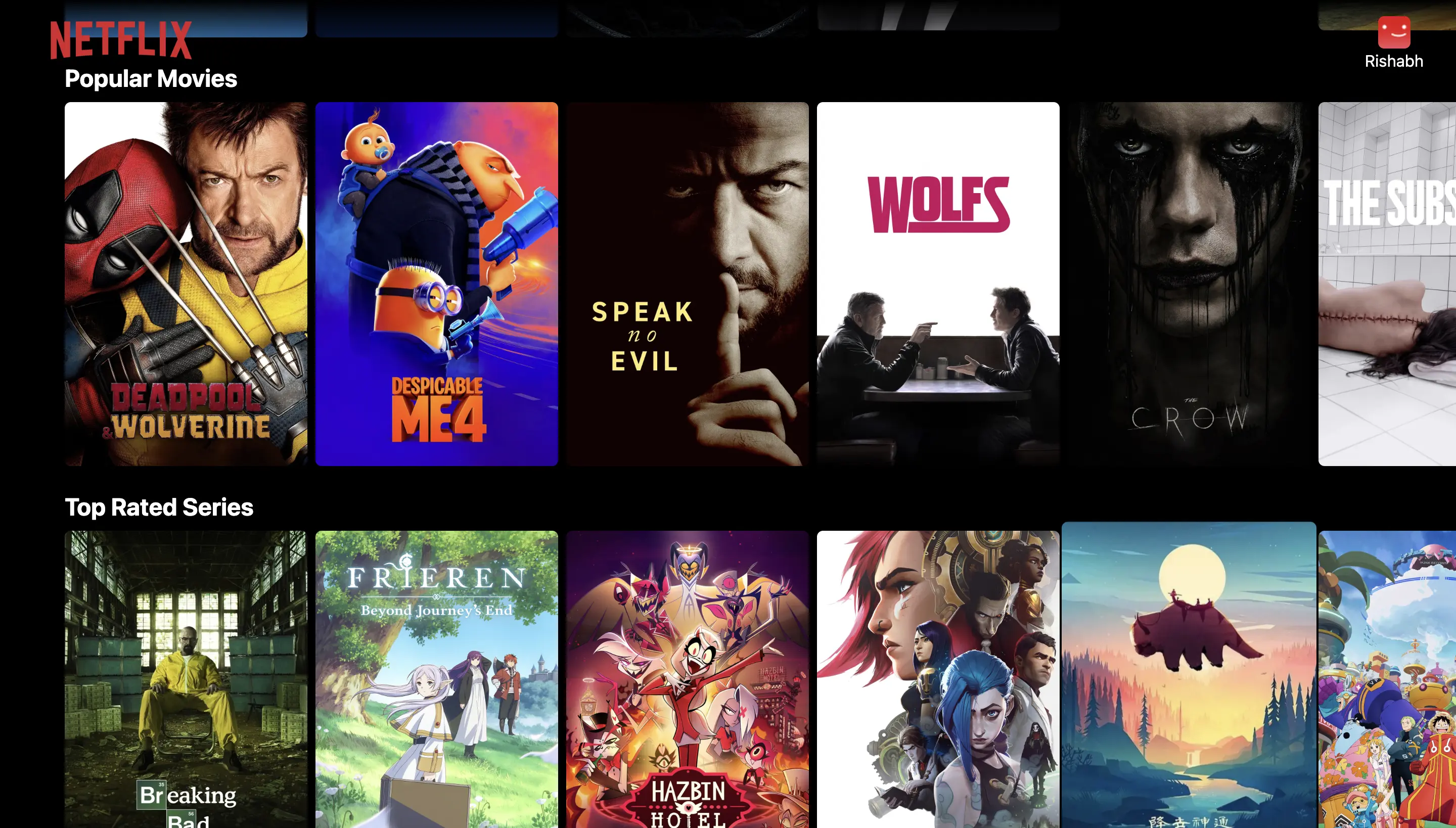

🎉 Received grant from SuperteamA platform to get movies and series information.

for "impersonating" Netflix

Blogs

Experience

Software Development Engineer

Signzy Technologies | Fintech Startup

Developed an intuitive user feedback system to enhance UX by 30% and provide actionable insights for future product development.

ReactNode.JSTypescriptMySQLMaterialUIUpdated the Know Your Customer (KYC) process by integrating third party APIs as mandated by Reserve Bank of India guidelines.

Node.JSReact.JSTypescriptMySQL

Software Engineer

Lensta Technologies (Givfin) | Fintech Startup

Led the development of a comprehensive platform to track and identify loan defaulters, integrating data from 10+ government and online sources. Improved Non-Performing Loan recovery rates by 25%.

ReactTypescriptMaterialUIJestPythonNode.JsMongoDBEnhanced the Loan Origination System by developing new features, updating the UIs and backend services, resulting in increased efficiency for the operations team.

React.JSReduxTypescriptMaterialUIExpress.JsMySQLDeveloped a standalone product to streamline the onboarding of client leads for sales executives and remove manual overhead by 100%.

React.JSReduxTypescriptMaterialUIExpress.JsMySQLDeveloped company's new website single-handedly based on design team's requirements and improved its performance as suggested by digital marketing team.

HTMLCSSBootstrapJavaScript